It’s best to transact through credit cards rather than debit cards as such instruments are insured by the bank against any kind of fraud. Thirty-year-old K Sekhar Babu of Whitefield realised this when he noticed that fraudsters had used his credit card to withdraw Rs 1.5 lakh in three equal installments, even though he hadn’t shared any OTP or CVV to anyone. When he filed an FIR and gave the police complaint copy to his bank, the financial institution conducted an internal enquiry and refunded Babu’s money.

The incident occurred at around 8.30pm on November 21, 2019. He received three text messages that Rs 50,000 was withdraw from his RBL Bank credit card, totalling Rs 1.5 lakh. “Immediately, I took screenshots of them and approached the cyber police station on Palace Road who directed me to complain at my local police station,” Babu told Residents Watch. “Then I found that I can also file complaints online, so I did. A month later, the Whitefield police asked me to come and file a written complaint.”

Armed with the FIR, Babu complained to the Mumbai-based RBL Bank who later found him ‘not guilty’ of sharing any secret codes, and refunded his money. “The fraudsters had bypassed by phone’s OTP and conducted the fraud,” says Babu. “Once I got back the money, I closed the card. This is the first time I have been a victim of such a financial fraud. I had used the credit card for five months before this happened.”

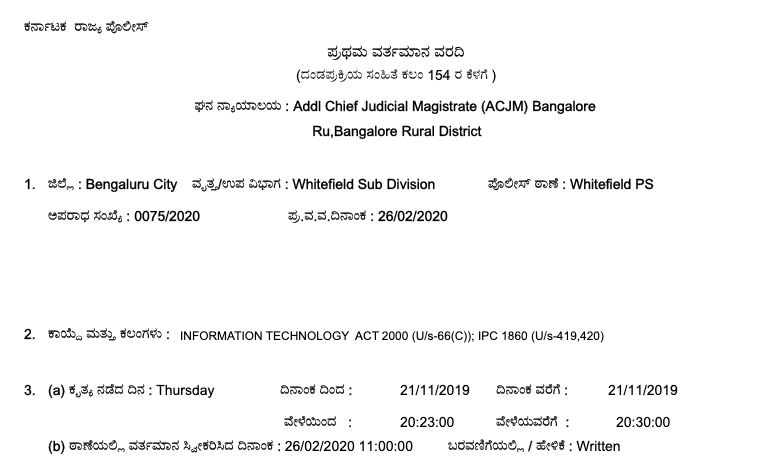

However, the system of FIRs in Bangalore police stations need to be examined. While Babu has an FIR with a different number (011) and dated for December, when he went online to access it with that number, there was some other complaint. When we found his real complaint number, it was 0075 and dated February 26, 2020. What really happened? His complaint has not only hopped on to a date two months later, but the FIR number has also changed.