By Aratrika Dey

The right to information should be a fundamental right of every citizen. Given the lack of transparency from the public sector banks in the country, the citizens need to know how to file an RTI (Right to Information) application. Banks serve as a part of the foundation of any economy. But much like any other sector, this sector has its share of suspicious dealings and large scale corruption. However, while all public sector banks are registered under the Right to Information Act, 2005, private sector banks are exempt from it.

A beginner’s guide to RTI

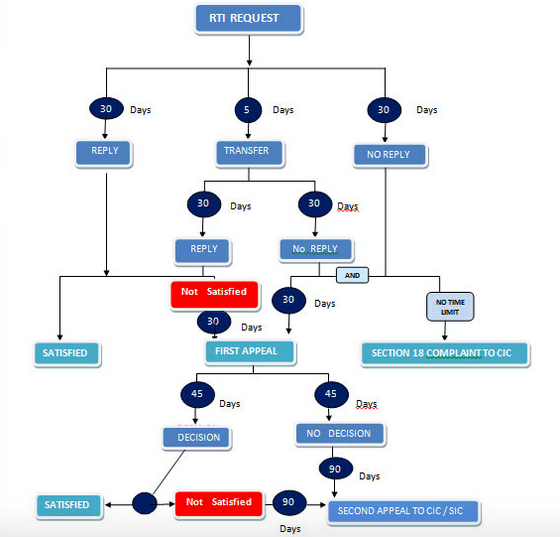

The Right to Information Act, commonly known as RTI, is an act of the Parliament of India, that came into existence in 2005 after continued efforts from anti-corruption activists. It sets rules and processes regarding the citizen’s right to information. Through this, citizens can request information on a variety of issues from governmental institutions. The concerned institution is required to serve the information asked for, within 30 days.

Process of applying for an RTI

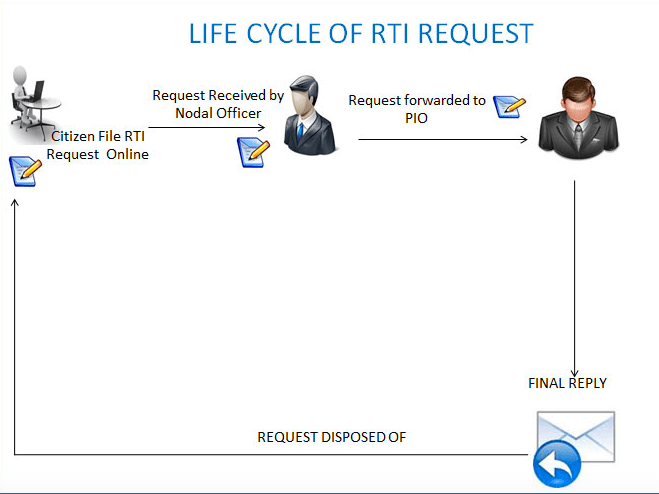

Today, the application process for filing an RTI involves both an offline and online option. However, there are certain things one should know before applying for an RTI, which is specifically centered around information one wants from any public sector bank in the country.

The procedure for filing an RTI is pretty basic and pocket-friendly. Make note of the step-by-step procedure before moving ahead with your query:

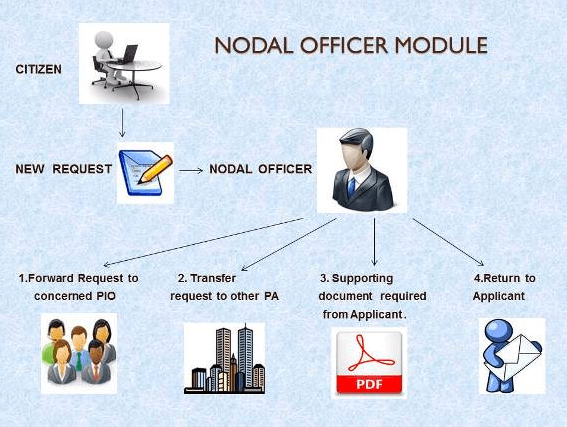

- Write an application on a plain sheet of paper in English, Hindi, or the official language of your state (since many states have their RTI application formats) with the information you require. The information should qualify under RTI and needs to be addressed to the Public Information Officer (PIO) or Assistant Public Information Officer (APIO). You can ask for the information you require in a CD or demand photocopies of the documents.

- Write your full name, address, and contact information. Mention the branch name and address of the Bank where you want the information from.

- If the information required is specific to your bank or bank account, the account number, name of the account holder, and details need to be included in the application.

- The subject should be written as “Information sought under RTI Act, 2005”. Make sure that there is clarity in the questions asked. The queries should be specific. Avoid collectively asking too many questions related to different departments/issues. Otherwise, the application might get rejected under the RTI Act.

- The application should be grammatically and technically correct – you need to convey what you want clearly. Many applications have been rejected due to wrongly-framed questions. The prescribed word limit is 500 words; it is best to keep the letter concise.

- Do a thorough research of the information you want. Check if the information is available on public domains, and if reports have been published specifically that answer your queries. Even if nothing specific comes out, research is a must because oftentimes, some related information may pop up. This will help you frame the application in a better way.

- Attach documents, if any, that you think will make the authorities answer your questions to your satisfaction.

- Buy a postal order for Rs 10, favoring CPIO, branch name of your bank, and address. Make sure to write the postal number in the application.

- The total cost depends on your demands. According to the RTI rules, A4 photocopies of documents are charged at Rs 2 per page. For document inspection, the applicant is given the first hour for free, and Rs 5 for every subsequent hour. Payments are to be made either with demand drafts or IPOs (Indian Postal Orders).

- Always take a photocopy of the application as a personal record. If the application is sent through post, the better option is to send it by registered post (to the bank branch) as you will have an acknowledgement after its delivery. If you are submitting the application to the PIO in person, take an acknowledgment from them.

- Care should be taken that the notary stamp used while posting (using speed post or registered post). The application should be dated less than six months before the application date. There are times when cases are rejected for something as small as using an expired notary stamp.

- Avoid online applications even if they are official such as this and this website. RTI activists suggest that applications be filed manually as most online sites, public or private, don’t work.

- Private banks do not fall under the RTI Act, 2005. However, there is a loophole to that. You can move your application to the Reserve Bank of India and ask them to obtain the required information from the errant bank for you. You can do this even if it’s a private bank if the bank’s activities are under the control of the RBI.

And finally…

For more clarifications, head over to Moneylife India’s portal as they have done several sessions catering to RTI, including one specifically targeting on how to get public sector banks to be answerable to you.